My Investment Process

The process begins with an open-ended conversation with clients, delving into their lives, their past, what they are currently doing, and what they are interested in doing in the future. I have found that this is the best way to naturally lead into a discussion about their investment objectives and what they need and want their money to do for them. At Stifel, we have knowledgeable and experienced wealth planning professionals that we work with to create a financial plan. The Stifel Wealth Strategist Report® is a comprehensive financial plan providing in-depth analysis on critical issues, such as retirement planning strategies, asset allocation, estate planning strategies, insurance needs, and education funding.

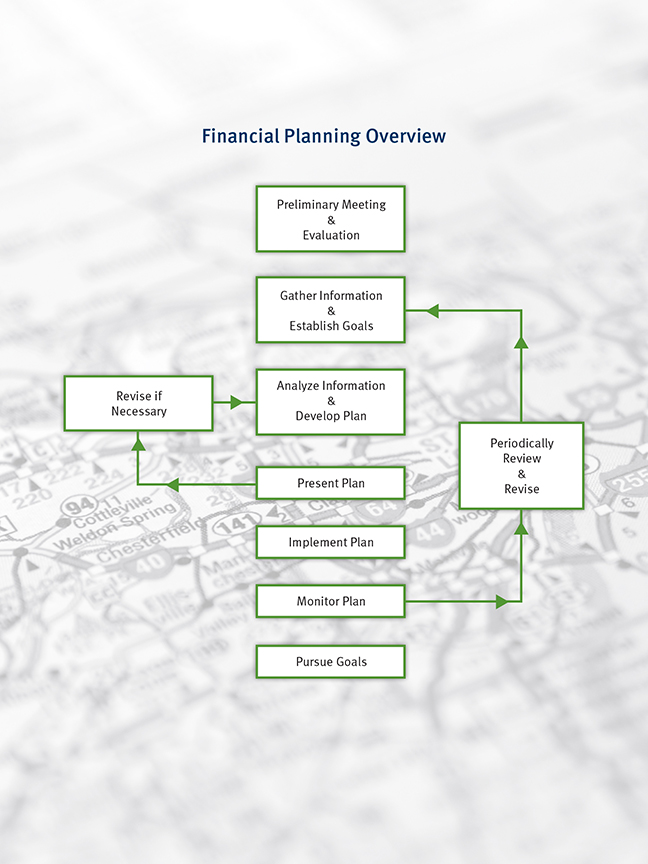

Your financial plan helps us target the appropriate asset allocation, which is the basis for portfolio guidance and management. Only after a thorough understanding of your investment objectives and risk tolerance are we ready to make recommendations for the portfolio. Financial planning and asset management are part of an integrated, ongoing process as diagrammed below.

Financial Planning Overview

Stifel and its associates do not offer tax or legal advice. You should consult with your tax or legal advisor regarding your particular situation. Asset allocation does not ensure a profit or protect against loss.